What is an SBA Loan? &…

Small businesses are the backbone of the economy, driving innovation, creating jobs,…

Simply provide some info about your business, and Fundify.io quickly matches you with lenders based on your business needs.

Small businesses are the backbone of the economy, driving innovation, creating jobs,…

Introduction Crowdfunding has revolutionized the way entrepreneurs and innovators bring their ideas…

Fundify is built for lenders to improve application experience and seamlessly organize documents and client communications. Scaling revenue has never been easier.

Super charge your sales and business development team with Fundify.io, the missing piece to grow your lender business.

Small businesses are the backbone of the economy, driving innovation, creating jobs,…

Introduction Crowdfunding has revolutionized the way entrepreneurs and innovators bring their ideas…

Simplifying and accelerating business loans

Find the right role for you at Fundify.io

Learn how to partner with Fundify.io

Increase your chances of approval with our unique compatibility system that’ll match you with the lender that’s right for you.

fundify.io breaks down barriers, making loans accessible to businesses of all sizes.

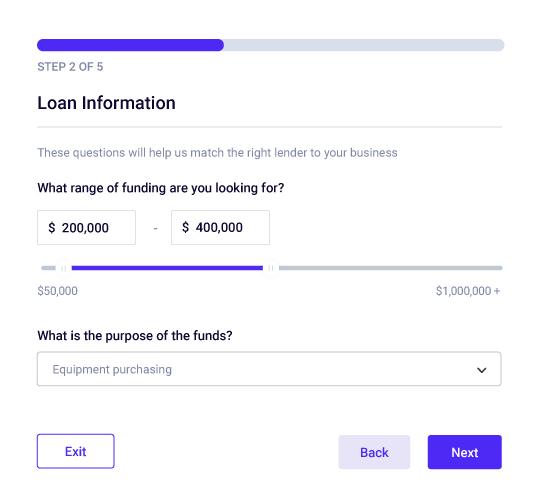

Fundify.io provides a straightforward and intuitive interface that guides users through the application process step-by-step.

With the information you share, Fundify.io uses AI and ML to match your funding needs with the most compatible lender for your business and loan type. Based on your matches Fundify.io prompts you for required documentation for each lender.

Fundify.io is built with easy to follow guides and templates designed to ensure you’re prepared for loan application success. Once your loan is funded, Fundify.io is a safe and secure platform to stay on top of reporting requirements for your funded loan.

Eu netus tellus habitasse nibh malesuada. Rutrum vestibulum turpis faucibus suspendisse non vehicula integer id.

Ultricies porttitor diam urna nisi efficitur magna mollis nunc taciti pulvinar. Nam at nisi dui id facilisis sapien luctus congue euismod aptent lobortis.

Ultricies porttitor diam urna nisi efficitur magna mollis nunc taciti pulvinar. Nam at nisi dui id facilisis sapien luctus congue euismod aptent lobortis.

Ultricies porttitor diam urna nisi efficitur magna mollis nunc taciti pulvinar. Nam at nisi dui id facilisis sapien luctus congue euismod aptent lobortis.

Ultricies porttitor diam urna nisi efficitur magna mollis nunc taciti pulvinar. Nam at nisi dui id facilisis sapien luctus congue euismod aptent lobortis.

Ultricies porttitor diam urna nisi efficitur magna mollis nunc taciti pulvinar. Nam at nisi dui id facilisis sapien luctus congue euismod aptent lobortis.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Aptent vehicula egestas donec turpis risus potenti montes fames.

Aptent vehicula egestas donec turpis risus potenti montes fames.

Aptent vehicula egestas donec turpis risus potenti montes fames.

Aptent vehicula egestas donec turpis risus potenti montes fames.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

Fundify.io is a free, intelligent loans platform giving you better access to loan options. The platform is designed to make it easy and fast to get the funding your business needs to thrive and grow.

Fundify.io is a venture-backed high-growth fintech business. Our priority is to build an app that drives value and helps small businesses getting a loan online.

When Fundify.io matches owners with a loan for small business (or lender), and the right online small business loan is funded, a commission is paid by the lender to Fundify.io.

The founding team has decades of combined experience helping new small businesses grow and get secured and unsecured loans online. Experience in small business banking as well as building some of the most powerful apps used by small businesses around the world. This experience, and knowing the small business loan journey can be better, is what powers Fundify.io’s mission.

Fundify.io is a free intelligent online loans platform that helps businesses gain better access to online small business loan options. Not a free-trial for a few days or weeks, Fundify.io is free—plain and simple.

Loan for small businesses are important as they serve as a vital lifeline for entrepreneurs aiming to establish or expand their existing or new small business. Both secured and unsecured business loans offer the necessary capital to fuel growth, innovation, and sustainability.

Fundify.io helps by providing small business owners more access to online loans and lenders to empower owners to transform their ideas into thriving enterprises.

Whether it’s funding for required equipment, inventory, or operational costs, online small business loans ensure that entrepreneurs have the means to seize opportunities and overcome challenges. With favorable interest rates and flexible repayment terms, getting a small business loans enables owners to invest strategically, hire skilled professionals with the right requirements, and pursue their long-term goals.

Ultimately, new small business loans online serve as catalysts for economic development, fostering job creation and driving local economies forward.

Organizing strong new small business loans requirements and applications can be challenging, but with the right requirements, approach and preparation, it becomes easy to start and more manageable to organize. You’ve come to the right place because Fundify.io is designed to help small business owners get a business loan, whether it’s secured or unsecured.

It’s important to thoroughly understand the loan requirements of any new business loans application and gather all the necessary documentation, such as financial statements, business plans, and tax returns. It’s recommended that you clearly outline your small business’s purpose, goals, and how the loan will be utilized to support business growth or address the specific needs of your small business.

Providing accurate loan requirements and detailed financial information, including cash flow projection requirements and collateral if required, demonstrates your business’s ability to repay the new business loan. It can also be helpful to seek guidance from professionals, such as accountants or business advisors, who can assist in structuring a compelling new loan application. By investing time and effort in organizing a strong loan application (or working with Fundify.io), you enhance your chances of getting a business loan you need.

Small businesses can utilize capital in various ways to foster growth and expansion. Here are some of the most common ways small businesses get a business loan.

One of the most popular reasons is to increase inventory. With additional capital, new small businesses can purchase more inventory, ensuring they have enough products to meet customer demand. Purchasing more inventory at once can also help small business owners secure better cost per unit prices increasing overall margin on total sales. In line with growth, investing in marketing and advertising is another common reason we see small businesses seeking loans. When small businesses allocate capital towards marketing efforts it can help small businesses reach a wider audience, increase brand visibility, and attract new customers driving overall profits for the business (even with the extra cost of small business loans borrowing).

Not as common, but often another reason small businesses leverage online loans is to upgrade equipment and technology. Investing in new or upgrading equipment or upgrading can enhance operational efficiency, improve product quality, and enable businesses to offer new services. This can lead to increased productivity and more revenue. Sometimes, small businesses are looking to invest in hiring and training employees. Capital can be used to recruit talented individuals, expand workforce, and provide required training programs.

Another common use of capital is to use a loan to buy a business or start business locations. With sufficient capital, business starts to open new branches, expand existing facilities, or lease larger offices. This enables them to reach new markets, serve a larger customer base, and establish a stronger presence in the industry.

It’s important for new small businesses to evaluate their specific needs and develop a growth strategy that aligns with their industry, target market, and long-term goals. Fundify.io’s all in one platform and newly created document room makes it easy to organize all your finances and start loan applications outlining all the reasons more capital can help grow your small business.

How much money are you looking for?